Doing things the right way: gemstones as an alternative inavestment

With the banks hardly paying any interest at all, a property bubble that could burst at any time, and a volatile share market, gemstones, the smallest form of capital investment, have climbed a long way up the ladder.

For several years, a marked increase in demand has been noticeable in the gemstone trade. Yet that demand is now facing limited resources, as Constantin Wild, the gemstone merchant from Idar-Oberstein, is well aware: “It’s becoming more and more difficult to get hold of high-value stones. Many deposits in Africa and Latin America are already exhausted. Imperial topazes, blue aquamarines and neon-yellow canary tourmalines, to name but a few.” Typically for this market, the price is also affected by the increased demand and short supply: “Prices for rubies and sapphires have multiplied several times over in recent years”, says Wild, who runs the family enterprise of that name, representing the fourth generation of his family in doing so.

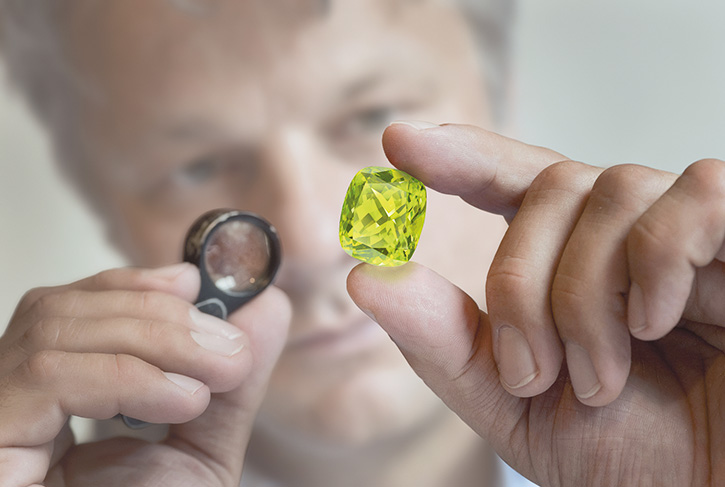

Jörg Lindemann, managing director of the federal association of the gemstone and diamond industry (BVED), also sees gemstones as a good investment option – if the conditions are right: “Gemstones are indeed an interesting form of value guarantee. Unlike currency or stocks and shares, the value of gemstones stays constant over generations. Having said that, investors should only consider very high-quality, top-class specimens.” The expert also advises against buying on one’s own initiative: “A buyer needs a profound knowledge of the market if he is to purchase a suitable stone of enduring value. Buyers should have a very clear knowledge of the situation regarding the demand for or deposits of the gemstone in question. A purchase is not to be recommended without a reputable partner.”

Scientific reports also help to protect the buyer against making a bad buy. “However, reputable institutes merely issue a report with scientific findings without making any statement about the value of the stones”, emphasises Lindemann. “Here too, buyers should consult only trustworthy institutions like the German Foundation for Gemstone Research (DSEF), the Swiss Gemological Institute (SSEF) or the Gübelin Gem Lab”, recommends Wild.

But what factors actually determine when a stone is valuable? For a long time, it was the “four Cs’ that held sway in the trade as the measure of all things: ‘carat, colour, clarity and cut’. These criteria, however, were developed for diamonds. In Constantin Wild’s opinion, they don’t go far enough: “Outstanding gemstones are often far rarer than diamonds”, says the much travelled connoisseur. For that reason, he has defined assessment criteria of his own, comprising them in the acronym SHORT: Shape – History – Origin – Rarity – Type. “All these factors should be taken into account in the purchase of a gemstone.” Wild too says it is important to have a trustworthy partner: “There are many jewellers in Germany who have an excellent knowledge, not only of jewellery, but also of loose stones.”

For Wild, who specialises in especially rare stones and stones of very intense colour, says that particularly colourful garnets and unusual tourmaline colours are in fashion for 2014. But he adds: “At the end of the day, a rare top-class gemstone is always a particularly glittering investment.”